The Silver Intitude GFMS Interim Silver Market Report 2016

Thomson Reuters GFMS Interim Silver Market Review

Reading Time:

1 min {{readingTime}} mins

At the Annual Silver Industry Dinner hosted by the Silver Institute, Johann Wiebe, Senior Analyst in the GFMS team at Thomson Reuters presented the GFMS / Silver Institute Interim Silver Market Review, which includes provisional supply and demand forecasts for 2016.

The Silver Institute Interim Silver Market review showcases that the physical deficit continues to persist despite softer fundamentals. The following highlights are key news updates from the silver market report:

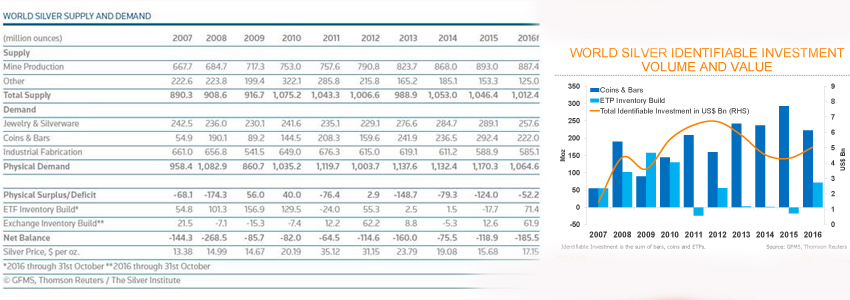

- The silver market is expected to be in an annual physical deficit of 52.2 Moz in 2016, marking the fourth consecutive year in which the market has realized an annual physical shortfall. While such deficits do not necessarily influence prices in the near term, multiple years of annual deficits can begin to apply upward pressure to prices in subsequent periods. This year, an expected 71.4 Moz net inflow into ETP holdings and a 61.9 Moz derivatives exchange inventory build on a year-to-date basis (end-October) have increased the impact of the physical deficit, bringing the net balance to -185.5 Moz, equivalent to approximately nine weeks of global demand. Above ground stocks, including ETP’s and exchange inventories, are estimated to reach 2,640.1 Moz in 2016; a 15% increase from the previous year.

- Silver prices this year through 11th November averaged $17.23/oz, which was 9.9% higher than in the same period in 2015. The GFMS team at Thomson Reuters forecasts silver prices to average $17.15/oz for the full calendar year, a 9.4% increase over the 2015 average.

- Total silver supply is forecast to fall 3% to 1,012.4 Moz in 2016. The decline is expected to be driven by a 1% drop in mine production, a 0.3% fall in scrap supply and net de-hedging of 20.0 Moz. Mine production is forecast to reach 887.4 Moz this year, which is almost 6 Moz lower than 2015 and the second highest year of production on record. Healthy increases in primary silver mine production, particularly in Peru, are being partially offset by losses in silver output from lead/zinc and gold mines. Following four years of consecutive declines, scrap supply is contracting only marginally, 0.5 Moz compared to 2015, which is a marked change from the 29 Moz annual average decline recorded over the previous four years. Higher local silver prices have been contributing to the improved sentiment.

The below table is a reduced form of the full “World Silver Supply and Demand” table featured in the World Silver Surveys:

- Silver bullion coin and bar sales are expected to contract 24% to 222.0 Moz this year. Bullion silver coins are forecast to reach 122.7 Moz in 2016, which is 7.9% below last year’s record of 133.2 Moz. The drop is unsurprising given the strong increase recorded in the prior year, when investors entered the market en masse to bargain hunt following the silver price decline during the second half of last year. Physical bar demand is expected to contract by 38% this year to 99.3 Moz. driven by a lackluster Chinese economy and weak consumer sentiment in North America. Demand in Europe, on the other hand, should improve by 14% reaching 14.5 Moz this year on the back of Brexit fears and a rising silver price. Physical bar and coin demand should account for 21% of physical demand in 2016, down from 25% in 2015 and up from just 5% ten years ago.

- Silver demand from the photovoltaics industry is forecast to increase by 11% to reach a record high of 83.3 Moz this year. The rise is driven by global solar installations, which should reach 70GW in 2016. China accounts for 70% of those additions in solar installations. Solar will make up 14% of total industrial demand this year, which is flat compared to 2015, but significantly up from just 1% a decade ago. Silver demand from ethylene oxide producers is predicted to remain flat this year at 10.2 Moz, following a doubling of demand last year. Of the annual total, approximately 10% is replacement demand for existing capacity whereas the rest represents a 6% rise in capacity additions, such as the Sadara project in Saudi Arabia. All other industrial sectors are expected to record minor losses in silver consumption this year, guided by challenging economic backdrops in various countries and continued thrifting and miniaturization trends in various electronic applications. Total industrial demand for silver is forecast to decline by 1% to 585.1 Moz, accounting for 55% of physical demand in 2016.

- Jewelry fabrication is forecast to drop 8% to 208.5 Moz in 2016. A decline in discretionary spending, thrifting, lower economic growth and a higher silver price have all contributed to the overall decline. In China, demand for high purity silver bracelets has been rising, however. Competition for low-end silver jewelry between smaller fabricators and branded outlets has intensified, weighing down on jewelers’ profitability and overall jewelry demand in Asia is expected to contract by 10% this year. North America mainly imports its silver jewelry, demand for which is forecast to slow this year, partially explained by continued trends towards yellow colored jewelry. North American domestic fabrication is set to reach 28.9 Moz, a decline of 6% year-on-year.

For further information please visit: www.silverinstitute.org

Author:

Sarah Salmon

Published:

{{'2016-12-01T13:25:19.1783990+00:00' | utcToLocalDate }}